When the eldest son inherits his father’s estate it is called the rule of?

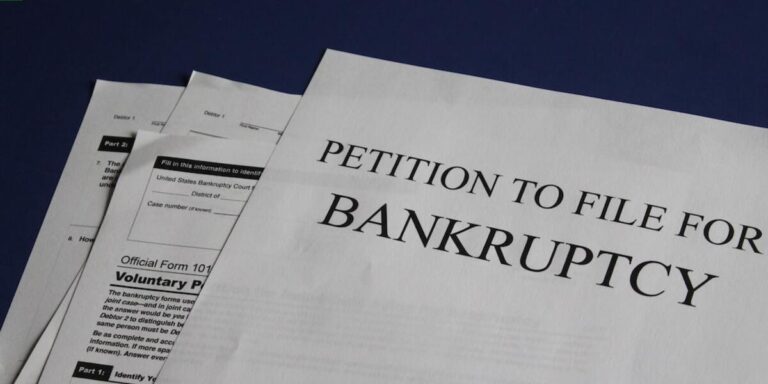

The rule of inheritance can be a complicated process, especially when there is no will in place. In Minnesota, the law states that if an individual dies without leaving behind a valid last will and testament then their estate must go through probate court to determine who should receive it. The eldest son typically inherits his father’s estate under this circumstance; however, understanding how Minnesota inheritance laws work with or without a will can help make sure your family’s assets are distributed according to your wishes after you pass away.

If you need assistance navigating the complexities of Minnesota Inheritance Law No Will (MNILNW), consulting with an experienced probate lawyer may prove beneficial for both parties involved in settling any disputes over the deceased person’s property and other possessions. A qualified attorney understands MNILNW statutes inside out so they have all necessary information on hand regarding what happens when someone passes away intestate—without having made provisions for succession via legal documents such as wills or trusts prior to death—in order to ensure everyone gets treated fairly during settlement proceedings.

Understanding the Rule of Primogeniture in Minnesota Inheritance Law

Primogeniture is a legal principle that determines the order of inheritance when there is no will. In Minnesota, it means that if someone dies without leaving behind any written instructions for their estate, then their assets are distributed according to state law. Primogeniture gives priority to direct descendants in determining who inherits property and other possessions from an individual’s estate. For example, under primogeniture rules in Minnesota, children would inherit before siblings or more distant relatives such as cousins or nieces/nephews.

When dealing with complicated matters related to probate laws and succession planning involving multiple family members located throughout different states (or even countries), having experienced counsel can be invaluable. A knowledgeable attorney familiar with all aspects of probate law including understanding how various states handle inheritance disputes through intestacy proceedings can help ensure your rights are protected during this difficult time by helping you navigate the complexities associated with filing claims on behalf of heirs-at-law against estates lacking valid wills or trusts; representing clients involved in guardianship hearings; assisting executors and administrators manage complex trust distributions while avoiding potential tax liabilities; negotiating settlement agreements between beneficiaries regarding division of assets among them; providing guidance on postmortem modifications to existing testamentary documents like revocable living trusts etc., An experienced lawyer can also provide sound advice concerning possible strategies for minimizing taxes owed by decedents’ estates due upon death so families may keep more money within the bloodline instead passing along excessive amounts directly into government coffers via taxation..

How a Probate Lawyer Can Help with No Will Estates

When a person dies without leaving behind a will, their estate is subject to Minnesota inheritance law. In this case, the state’s intestacy laws come into play and dictate how assets are distributed among family members or other beneficiaries of the deceased’s estate. It can be difficult for surviving family members to navigate these complex legal matters on their own; however, an experienced probate lawyer can help guide them through each step of the process.

A probate attorney in Minnesota has knowledge about all aspects of no-will estates including what types of documents need to be filed with local courts as well as any deadlines that must be met by executors or administrators involved in settling such cases. They also have experience dealing with issues related to creditor claims against an estate and resolving disputes between heirs regarding who should receive which asset from it – both common occurrences when there is no valid will present at death. A qualified professional understands how best to protect everyone’s interests during this emotionally trying time so that things go smoothly throughout every stage until everything is finalized according to applicable state statutes governing intestacy succession rules for those without wills in place prior passing away .

The Implications and Consequences of the Elder Son’s Inheritance

The implications and consequences of the elder son’s inheritance can be complex, especially in cases where there is no will. In Minnesota, when someone dies without a valid will or trust that outlines their wishes for how to distribute assets after death, state law determines who inherits property through an intestate succession process. Under this system, if both parents are deceased then the eldest child typically receives all inherited assets as long as they have reached legal age (18). This means that any younger siblings may not receive anything unless specific provisions were made prior to death.

In these situations it’s important to consult with a probate lawyer experienced in Minnesota Inheritance Law so you understand your rights and responsibilities under state law before making decisions about estate distribution or other related matters such as taxes or debts owed by the decedent. A qualified attorney can also help ensure that everyone involved understands what steps need to be taken legally while navigating potentially complicated family dynamics between siblings over inheritances left behind by loved ones – something which could otherwise lead to costly litigation down the road if not handled properly from day one.

Navigating Complexities in Minnesota Estate Planning Without a Will

Estate planning without a will can be complex, especially in Minnesota. The state’s inheritance laws determine who receives the assets of an individual when they pass away and if there is no valid will or trust, these decisions are left to the court system. Without proper guidance from an experienced probate lawyer it can be difficult for families to understand their rights and obligations under Minnesota law regarding inheritance matters.

A probate attorney can provide invaluable assistance with navigating complexities related to estate planning without a will in Minnesota by helping family members understand how property is distributed according to intestacy rules established by statute; which creditors must receive payment before heirs inherit anything; what taxes may need paid on inherited items such as real estate or investments; whether special elections should be made concerning life insurance proceeds that could benefit surviving spouses or children more than just going into general distribution among all beneficiaries named in the decedent’s last Will & Testament (if any); etc.. A qualified legal professional familiar with both federal and state regulations governing estates also has access resources not available through other sources like accountants, financial advisors, banks etc., so having one on your side during this process makes good sense.

Frequently Asked Question

-

Does Minnesota have a transfer on death deed?

-

Who are primary heirs?

-

When the eldest son inherits his father’s estate it is called the rule of?

-

Do all estates go through probate in Minnesota?

-

How do you determine legal heirs?

-

Who are legal heirs of deceased husband?

-

Is Minnesota a community property state?

-

How many classes of legal heirs are there?

-

What is the intestacy law in Minnesota?

-

What is the order of inheritance in Minnesota?

The Minnesota laws governing transfers on death must be followed, including the sections 507.24, 507.34, 507.34, 507.34, 508.48 and 508A.

The primary heir is one of the three sharers. The main sharers that cannot be removed are father, mother, and daughter.

Primogeniture refers to the principle where the inheritance favors the oldest son.

Your estate should be probated if your personal property is more than $75,000, or if you have real estate that your only name contains.

If the decedent does not have any children or spouse, who is the legal heir? Parents, children and spouse are the legal heirs immediately after the death. If a person dies without immediate legal heirs then their grandchildren are the legal heirs.

According to the Hindu Succession Act (Hindu male), husband’s immediate legal heirs will be his son, daughter and mother. Children of predeceased boys and girls, widows, etc.

Community Property States. Minnesota is a state that is separate from the rest of Minnesota. If they do not agree to joint ownership, spouses will own all the earnings and acquisitions made during marriage.

There are two types of legal heirs: Class I and Class 2. According to Hindu succession law, property that is left behind by a Hindu man without leaving a will, passes primarily to his Class I heirs, which are the widow, children, and mother in an equal amount.

Your children receive an “intestate portion” of any property if you pass away without making a Minnesota will. The amount of your children’s shares will depend on the number of children you have and whether you are married or divorced.

The following are the beneficiaries of your estate in case you do not make a will: children and spouse, parents, siblings, grandchildren, aunts/uncles and cousins. The order of intestate succession is very similar to the way many people would act if they had a will.

Conclusion

The rule of Minnesota inheritance law no will is a complex and important topic that can have far-reaching implications for the family. It’s essential to make sure you understand all aspects of it before making any decisions regarding your father’s estate. A probate lawyer who specializes in this area should be consulted if there are questions or concerns about how things should proceed legally. Additionally, our website provides trusted links and reviews on reputable lawyers with experience in handling these types of cases so that users can find an attorney they trust to help them navigate through the process successfully. Ultimately, understanding Minnesota inheritance laws without a will requires careful research and planning but doing so could ensure peace of mind when dealing with such matters as inheriting one’s father’s estate.